A Stock Has a Beta of 1.15

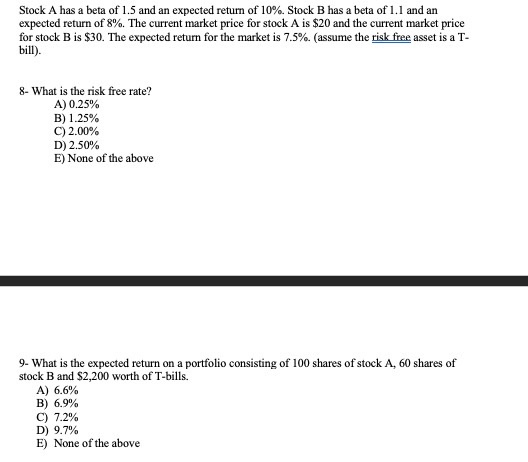

The pure rate of interest is 325. A stock has a beta of 115 the expected return on the A stock has a beta of 115 the expected return on the market is 109 percent and the risk-free rate is 38 percent.

Solved A Stock Has A Beta Of 1 15 The Expected Return On Chegg Com

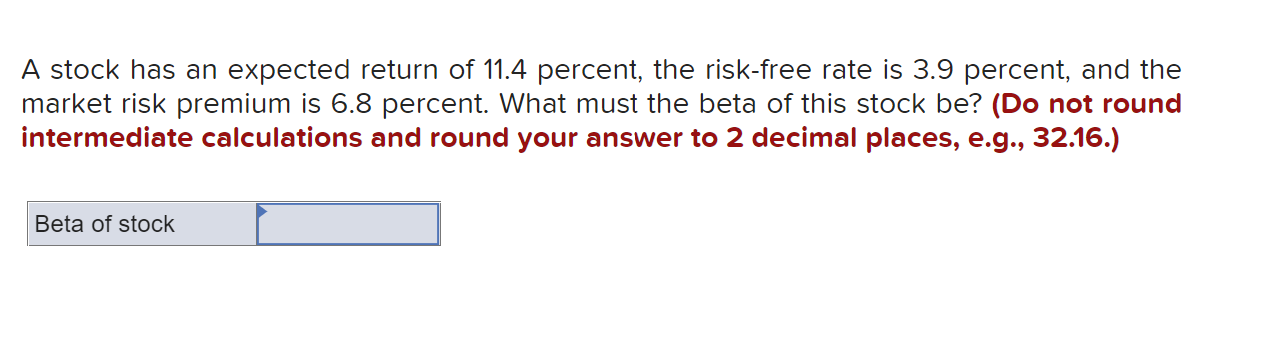

A stock has a beta of 115 the expected return on the market is 103 and the risk-free rate is 38.

. What must the expected return on this stock be. A stock has a beta of 115 the expected return on the market is 109 percent and the risk-free rate is 45 percent. What is the CAPM estimate for this stocks rE.

A stock has a beta of 115 the expected return on the market is 114 and the risk-free rate is 49. A stock has a beta of 115 and an expected return of 114 percent. What must the expected return on this stock be.

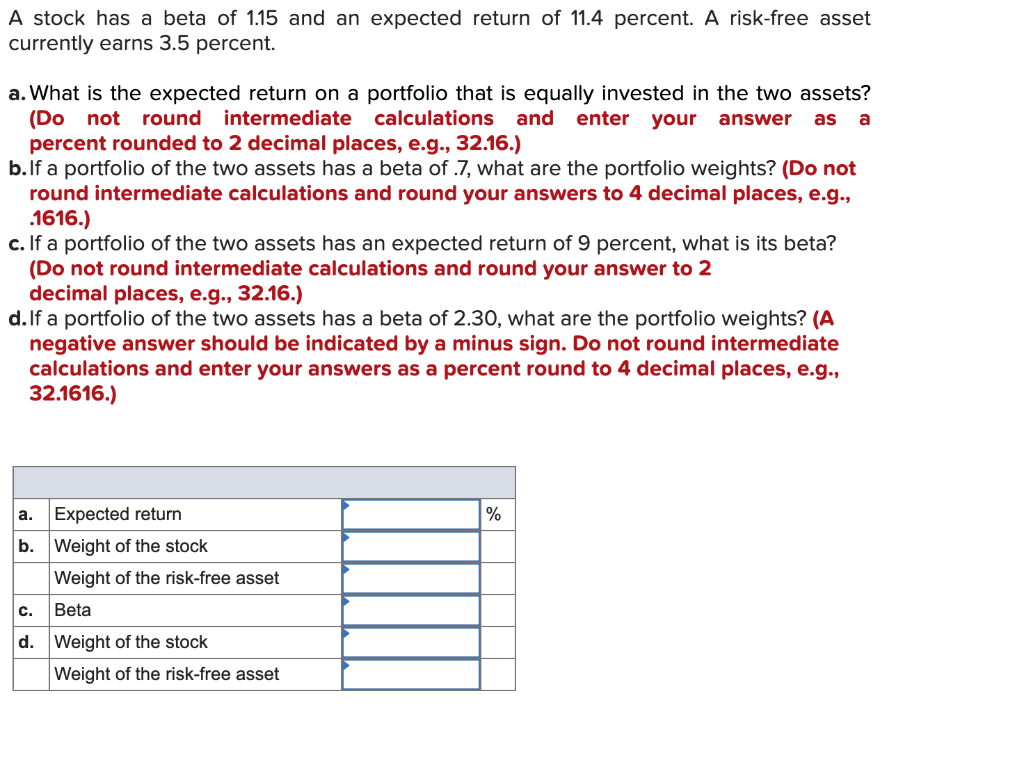

What is the expected return on a portfolio that is equally invested in the two assets. Setting up the equation for the beta of our portfolio we get. A risk-free rate asset currently earns 35 percent.

Round the final answer to 2 decimal places Expected return Expert Answer Expected return risk-free ra. Thus the answer is 1138. What must the expected return on this stock be.

Round the final answer to 2 decimal places Expected return. What must the expected return on this stock be Advertisement Marmar5804 is waiting for your help. Check out a sample QA here See Solution star_border.

A stock has a beta of 115 and an expected return of 114 percent. What must the expected returnon this stock be. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places eg 3216.

What must the expected returnon this stock be. Answer 10 5 0 291361 Answer. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places eg 3216.

Calculate the market risk premium. Round your answer to 2 decimal places eg 3216 Expected return Best Answer 91 11 ratings Expected re. Do not round intermediate calculations.

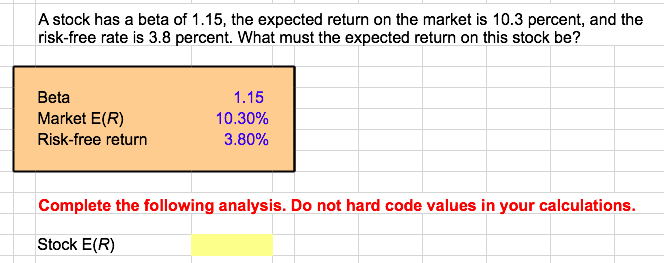

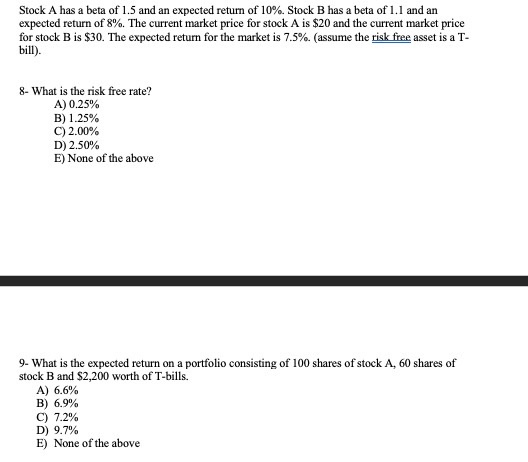

A stock has a beta of 115 the expected return on the market is 113 percent and the risk-free rate is 36 percent. What is the expected return on a portfolio that is equally invested in the two assets. 1112 Using CAPM A stock has a beta of 115 the expected return on the market is 111 percent and the risk-free rate is 38 percent.

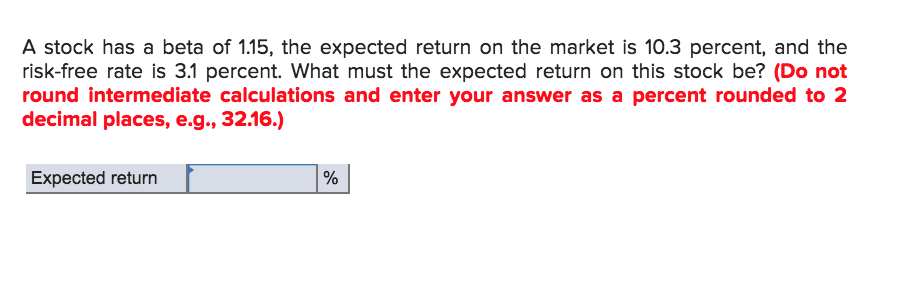

Return on Market is given at 103. A stock has a beta of 115 the expected return on the market rm is 103 percent and the risk-free rate is 31 percent. What is the expected return on a portfolio that is equally invested in the two assets.

A stock has a beta of 115 The expected return on the market is 103 The risk-free rate is 38 Therefore the expected return on the stock can be calculated as follows Expected return Risk-free ratebeta expected return on the market-risk-free rate 38115 103-38 38 11565 387475 1128. Beta is given at 115. What is the required rate of return on this stock if the market risk premium is 6 percent.

Expert Solution Want to see the full answer. A stock has a beta of 115 and an expected return of 104 percent 1000 CAPM. A stock has a beta of 115 the expected return on the market is 109 percent and the risk-free rate is 38 percent.

The pure rate of interest is 325 percent and investors require a 3 percent inflation premium. A stock has a beta of 115 and an expected return of A stock has a beta of 115 and an expected return of 104 percent. What is the expected return on a portfolio that is equally invested in the two assets.

βp 10 13 0 13 127 13 βX 13βp1-13 127 βp173. A stock has a beta of 115 the expected return on the market - E RM is 103 percent and the risk free rate is 31 percent. 03012022 Business College answered A stock has a beta of 115 the expected return on the market is 113 percent and the risk-free rate is 36 percent.

A stock has a beta of 17. If a portfolio of the two assets has a beta of 7 what are the portfolio weights. If a portfolio of the two assets has a beta of 7 what are the portfolio weights.

Do not round intermediate calculations. A risk-free asset currently earns 35 percent. What must the expected return on this stock be.

A stock has an expected return of 134 percent and a beta of 115 and the. What must the expected return on this stock be. This preview shows page 1 out of 1 page.

Do not round intermediate calculations. A stock has had returns of 189 percent 289 percent 228 percent 10 percent 347 percent and 269 percent over the last six years. Check out a sample QA here See Solution Want to see the full answer.

What must the expected return on this stock be. Answer of A stock has a beta of 115 the expected return on the market is 113 percent and the risk-free rate is 36 percent. Wrote Analysts has just used the CAPM model to compute an rE of 18679 for the VaperWare company.

It found rE by among other things. Add your answer and earn points. A stock has a beta of 112 the expected return on the market is 106 percent and the risk-free rate is 465 percent.

What must the expected return on this stock. View the full answer. A risk-free asset currently earns 38 percent.

BusinessFinanceQA LibraryA stock has a beta of 115 the expected return on the market is 109 percent and the risk-free rate is 45 percent. What must the expected return on. Questions Answers Accounting Financial Accounting Cost Management Managerial Accounting Advanced Accounting Auditing Accounting - Others Accounting Concepts and Principles Taxation.

A stock has a beta of 115 the expected returnon the market is 106 percent and the risk-free rate is 45 percent. Using SMLCAPM find the expected return on the stock. Return on a stock Risk-free rate Beta Return on Market - Risk free rate 31 115 103 - 31 1138.

Expected Return The expected return is the profit or loss an investor anticipates on an investment that. A stock has a beta of 17. Round your answer to 3 decimal places.

A risk-free asset currently earns 38 percent. A stock has a beta of 115 the expected return on the market is 113 percent and the risk- free rate is 36 percent. A stock has a beta of 115 the expected returnon the market is 11 percent and the risk-free rate is 5 percent.

E R P 05 0114 05 0035 00745 745. Expected Return The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return RoR. A stock has a beta of 115 and an expected return of 104 percent.

Solved A Stock Has A Beta Of 1 15 The Expected Return On Chegg Com

Solved Stock A Has A Beta Of 1 5 And An Expected Return Of Chegg Com

Solved A Stock Has A Beta Of 1 15 The Expected Return On Chegg Com

Solved A Stock Has A Beta Of 1 15 And An Expected Return Of Chegg Com

Comments

Post a Comment